Distressed debt will further strengthen the trend towards private debt financing

In the current market environment, more and more property developers and portfolio holders are looking for refinancing solutions. This is because the sharp rise in interest rates means that properties acquired during the low-interest phases with, for example, five-year fixed financing will be significantly more expensive to finance in the future. At the same time, banks are tightening their lending guidelines. Inflation has made construction costs for project developments more expensive. Exit options are disappearing because the transaction market is weakening and buyers are waiting on the sidelines. The result of this pincer movement: There is a lack of liquidity. The completion of projects is delayed. And if the necessary capital buffer is lacking to complete a project or even start it at all, there is even the threat of insolvency.

While in the past the financing needs of property investors were primarily covered by traditional bank loans (real estate loans), banking regulation has created scope for alternative financing models. As a result, there is unlikely to be a major wave of purchases of non-performing loans (NPLs). This is because the capital structure of financing is completely different today than it was during the financial crisis, as the banks’ senior share is significantly lower. Back then, it was worthwhile for NPL specialists to buy large NPL portfolios from the banks at a discount and realise them because valuable collateral was available. Today, however, mezzanine financing is under water because activity on the transaction market has decreased enormously.

In the increasingly fragmented financing landscape, we see a growing need for advice on refinancing. This is because a number of standstill agreements with financiers are expiring in the current market shakeout phase. In the course of refinancing negotiations, project developers and portfolio holders are finding that they are unable to fulfil additional requirements. At the latest when companies with high debt ratios present their annual financial statements for 2023, we therefore assume that further market participants could run into acute difficulties.

In this situation, we expect more products to come onto the market: both in the form of non-performing loans that are sold and in the form of properties that serve as collateral. However, the turnaround in interest rates means that supply and demand on the transaction market have not yet come together for long stretches. Many market participants are acting cautiously and there is a lack of liquidity on the market. As a result, it is becoming increasingly difficult for investors to find an exit for non-performing exposures.

At the same time, it can be observed that increasingly strict regulatory requirements and valuation specifics (rating, equity backing) mean that certain industry segments, submarkets or projects are hardly being financed by banks, or only at very unfavourable conditions. Banks typically adopt a pro-cyclical market behaviour. Economic downturns lead to lower corporate profits and therefore to rating downgrades. The capital backing required by banks increases, leaving little room for manoeuvre for new business. In addition, after the expiry of fixed interest rates, there are more risky loans on the books whose property income can no longer generate the higher interest rates. Anti-cyclical investment and financing strategies are very difficult to implement in this phase. It is precisely in this situation that alternative, entrepreneurial financing partners are becoming increasingly important.

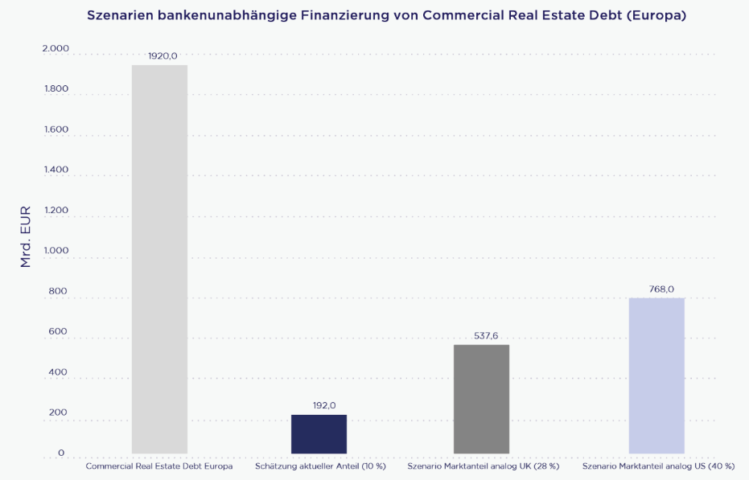

As we pointed out in a study at the beginning of the year, the trend towards B2B and private debt financing will therefore continue to strengthen, although this growth will take place almost exclusively in the B2B sector for regulatory reasons.

The high financing volumes and customised structures require professional management and controlling. Efficient real estate private debt funds will therefore play a key role in the expected market growth in the private debt financing segment. Providers who can handle the entire process from origination to reporting and repayment have an advantage here.

Source graphic: Barings Bank, PGIM RE, Bayes Business School, London; Empira – own calculation and presentation as at December 2022.