Figures on the Swiss economic area

The Swiss real estate industry is traditionally known for its stability and prosperity. Both the COVID 19 pandemic in 2020, inflation and the current armed conflicts have a significant impact on the Swiss economy.

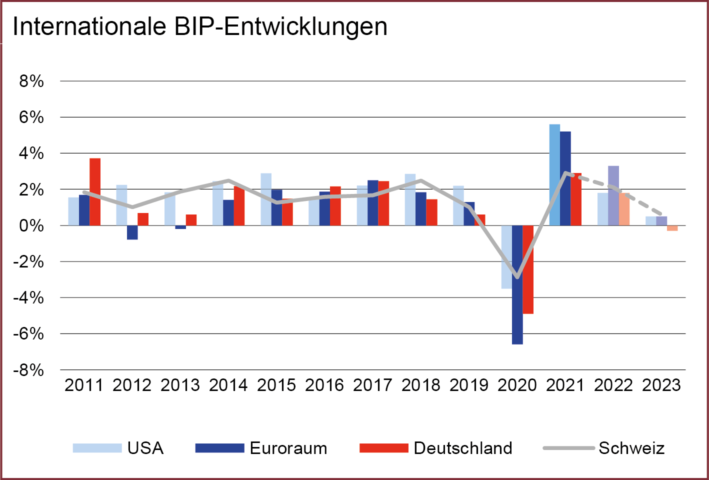

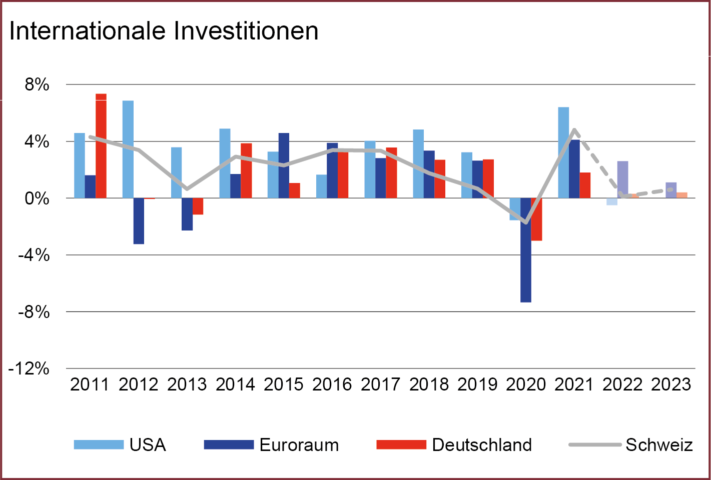

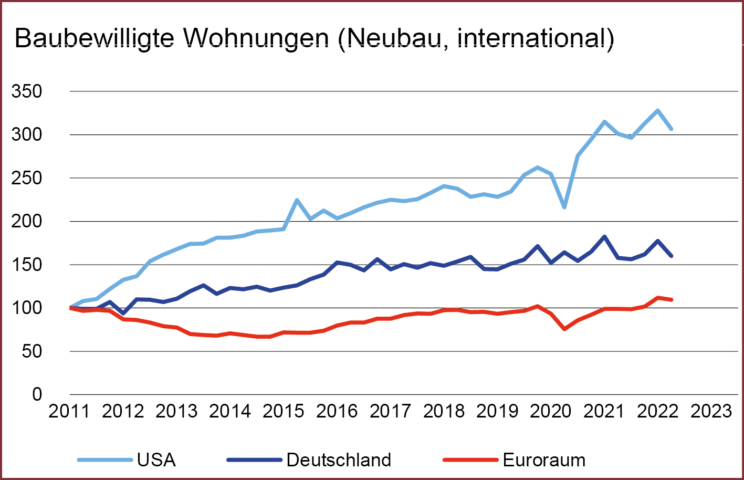

International GDP development as well as investments have recovered excellently in 2021. However, the latest developments

show that investment volumes are currently subdued and GDP development is cooling down worldwide. Economic analysts’ forecasts predict a slowdown in 2024 and a possible downward trend.

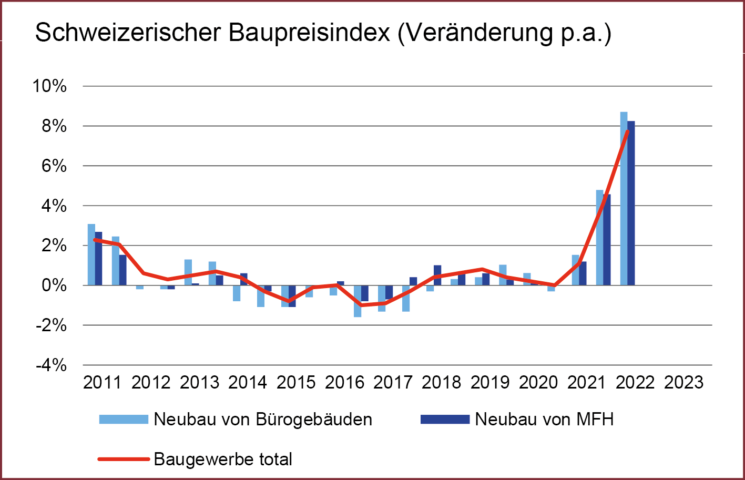

The pandemic hardly plays a role in the media any more, but its consequences continue to be felt. In addition, rising energy and food prices as a result of the war in Ukraine, Corona measures by major economic players and supply chain problems have led to uncertainty, which is reflected in rising inflation rates. With the interest rate hike, the SNB was able to calm things down and is slightly above target. The forecasts of a slowdown in economic growth are reflected in a restrained development.

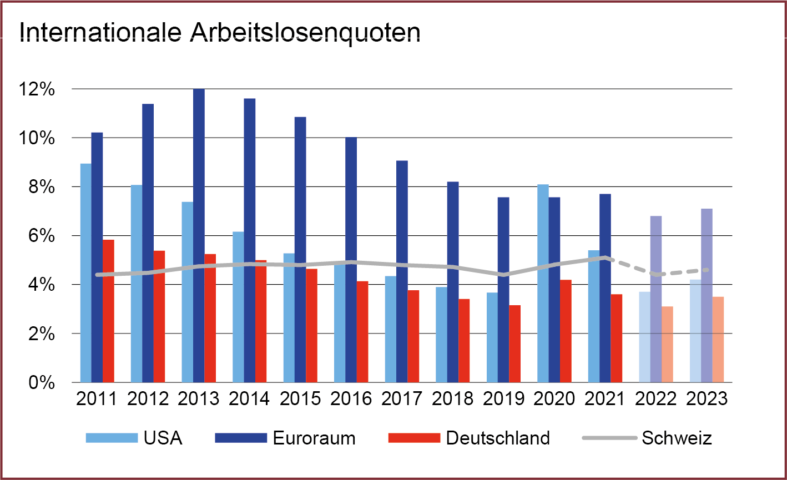

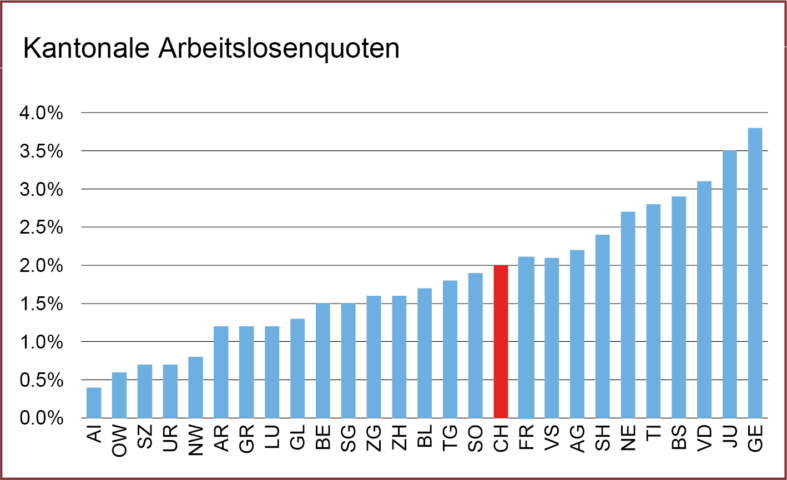

Real incomes in Switzerland have fallen slightly, which, together with the pandemic-related pent-up demand in the consumer sector, is having a positive effect on the economy. The outlook for the labour market is good and an upswing is possible by 2024.

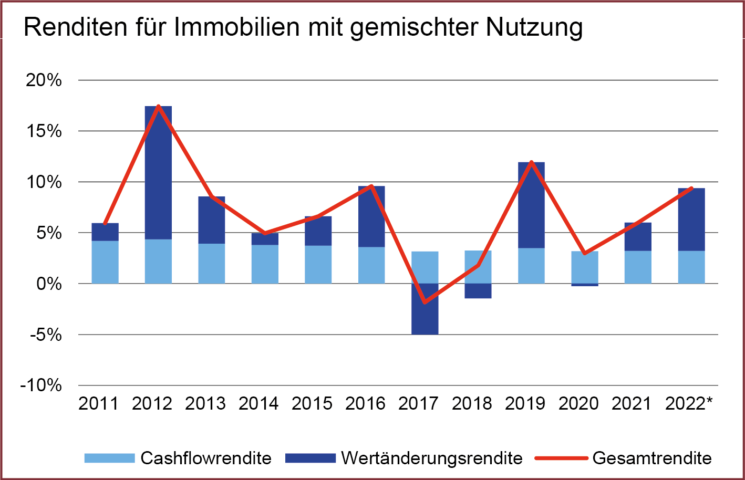

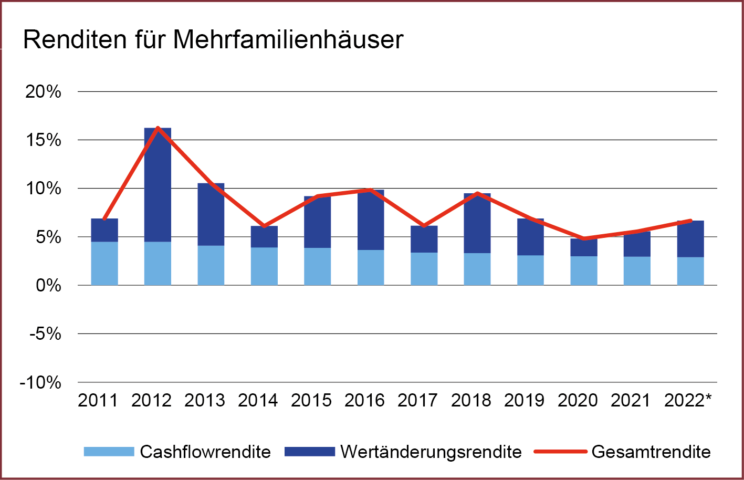

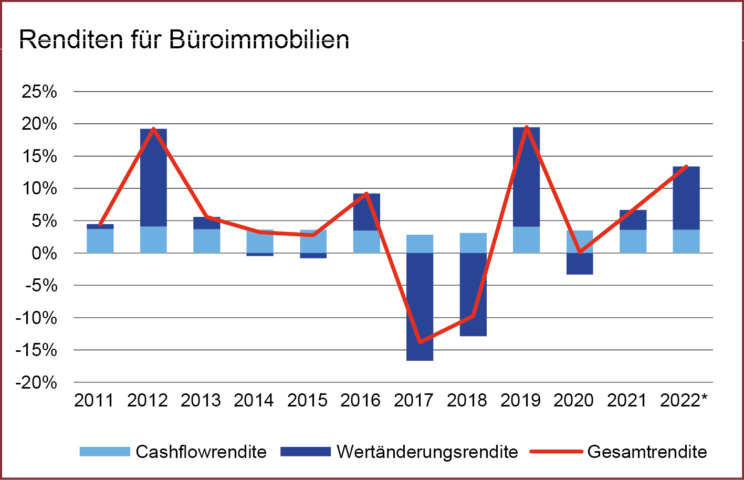

The residential real estate market is robust and could not be affected by the financial crisis, the Corona pandemic or the war in Ukraine. The Swiss office market is unimpressed by the negative news from the global economy.

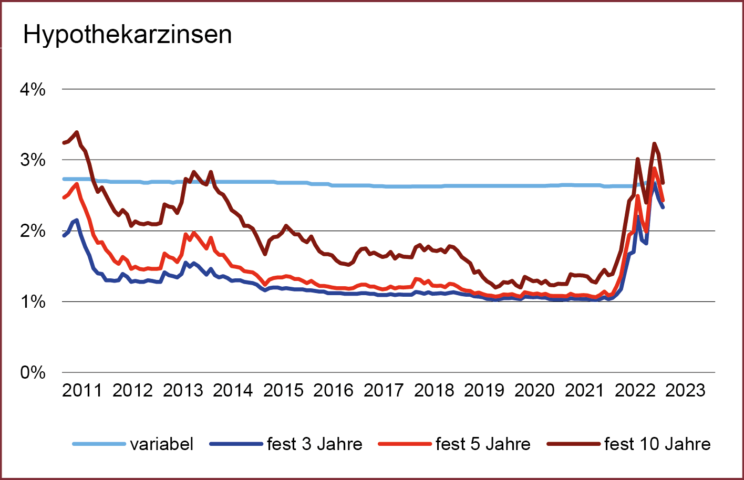

Further interest rate steps by the SNB are expected and yields could rise slightly. However, due to immigration, vacancies in the periphery are falling and demand for space in the centres remains high, leading to rising market rents.

In the area of commercial real estate, yields are not expected to rise in the near future, as interest rates could rise. There is a tendency for market values to fall, which could be cushioned by investors’ investment pressure.