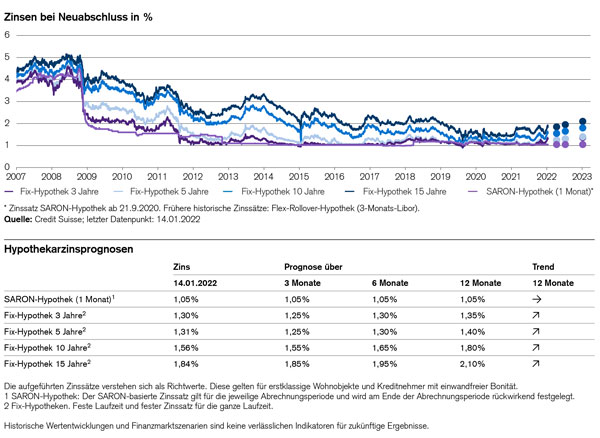

Credit Suisse mortgage rate forecasts

Economic growth of 2.5% is expected for 2022. Despite slight increases, mortgage interest rates will remain low in 2022. Switzerland is significantly less affected by rising inflation than the USA or Europe. An increase in the key interest rate is therefore not to be expected by the end of 2023.

The COVID-19 pandemic will keep Switzerland busy for a while, but is only likely to slow down the economic recovery temporarily. We expect economic growth of 2.5% for the current year. The growth is therefore weaker than in the previous year (4%). Switzerland is currently much less affected by rising inflation than the USA or the euro area. But the inflation rate in Germany is also likely to be above the average for the last two years. This remains within the target range of the Swiss National Bank. An increase in the key interest rate is therefore not to be expected until at least the end of 2023. The interest rates for SARON mortgages, which have replaced the previous Flex rollover mortgage (3-month Libor), are therefore likely to remain at their lows for the next 12 months. As a result of rising inflation and the start of a series of anticipated interest rate hikes in the US, Fix mortgage rates have risen significantly in recent weeks. In contrast to the SARON mortgages, we anticipate a further slight increase in interest rates for Fix mortgages by 5 to 30 basis points over the next 12 months. However, as before, the development is likely to be accompanied by ups and downs. Overall, interest rates will therefore remain at a historically very low level over the next 12 months.