Swiss companies start the year on a more optimistic note

The business situation in the Swiss private sector improved noticeably at the start of 2026. Companies are more confident about the coming months than they were at the beginning of 2025. The upturn is being driven primarily by the manufacturing industry, but the construction, financial, retail and hospitality sectors are also reporting a noticeably more positive mood.

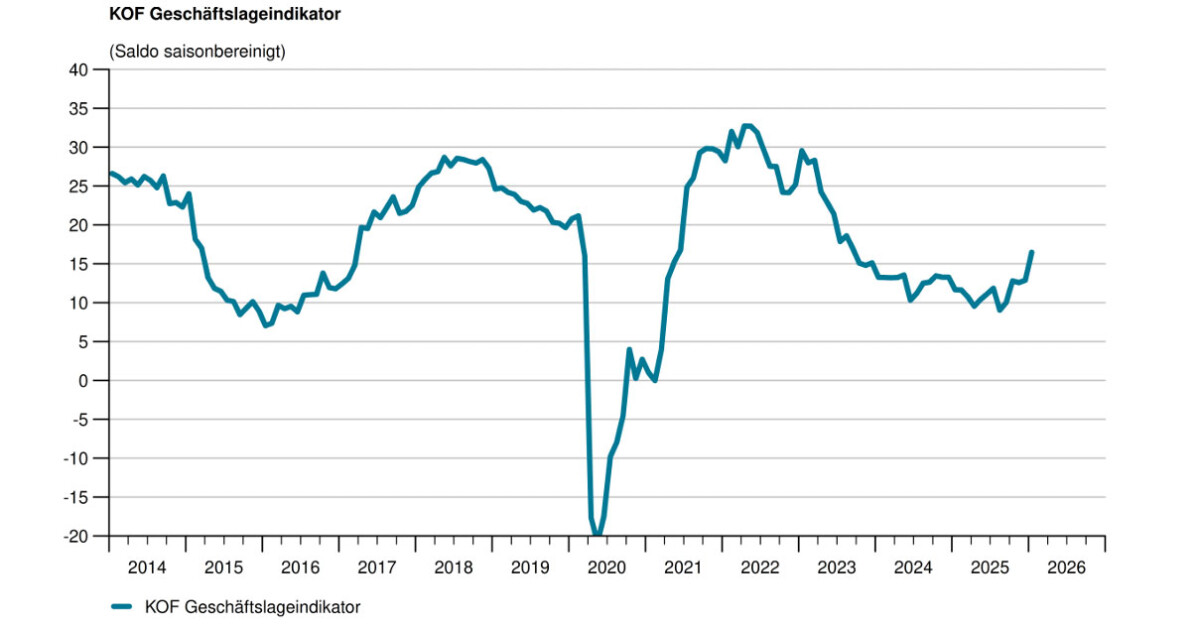

The KOF Business Situation Indicator rose for the second month in a row in January, signalling a much more favourable starting position than a year ago. The business situation in the manufacturing industry in particular has brightened considerably, indicating a revival in demand and capacity utilisation.

financial and insurance services, wholesale, catering and construction are also reporting rising business situation indicators, while the retail trade is at least slightly improving. The situation in other services remains largely stable, with only the project planning sector reporting a slight slowdown. Overall, this shows a broad-based improvement across the Swiss economy.

industry as an anchor of sentiment

Looking ahead to the next six months, optimism prevails in many sectors. The manufacturing industry in particular is anticipating a further improvement in business activity, confirming its role as an anchor of sentiment at the start of the year.

expectations have also brightened in the retail trade, construction, financial and insurance services and project planning sectors. By contrast, the hospitality, wholesale and other services sectors are somewhat more cautious about the coming months, although the majority of them remain moderately positive.

more recruitment

Many companies are planning to take on additional staff. This is particularly evident in the hospitality industry, which is looking to expand its workforce but is finding it increasingly difficult to find suitable employees.

the construction industry and the project planning sector are the most likely to report a shortage of skilled labour, which brings existing capacity bottlenecks into sharper focus. For managers and HR managers, this means that competition for qualified labour is continuing to increase in several key sectors.

moderate momentum without new signs of inflation

Despite the economic upturn, wage expectations remain stable. As in the October survey, companies expect gross wages to rise by 1.3% on average over the next twelve months, with above-average increases in the hospitality industry, the project planning sector and the construction industry.

companies are also not expecting a turnaround in consumer prices. The expected inflation rate now stands at 0.9%, practically the same level as in the October survey (1.0%). The picture for monetary and wage policy is therefore one of moderate, well-anchored price and wage developments.

broad base in the real economy

The survey is based on around 4,500 companies from the manufacturing, construction and central services sectors, which corresponds to a response rate of around 56%.

the KOF Business Situation Indicator thus provides a robust picture of the mood among managers. The Swiss private sector is starting 2026 with a broad base, cautious confidence and no discernible inflationary momentum, while at the same time increasing pressure on the labour market in key construction and service sectors.